Commercial Lending Guide – SME Lending

- Original article by Mortgage Professional Australia

- 27 May 2019

A growing opportunity.

A growing opportunity.

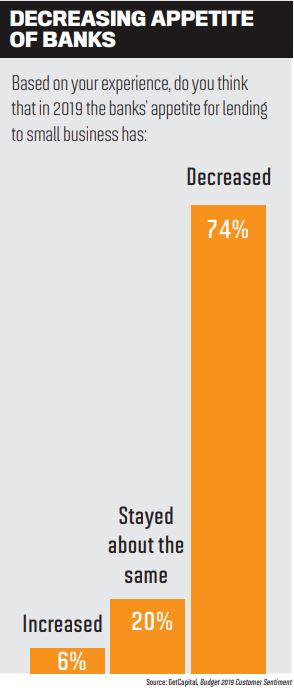

It is estimated that another 250,000 new small businesses will open in the next 12 months, but as mainstream banks pull back from lending to SMEs, where will they get the money they need to run those businesses? Small businesses already make up 97% of the 2.2 million businesses across Australia and rely on funding for many things, such as hiring new staff, buying new equipment, or keeping on top of their cash flow.

A Sensis Business Index report released in February 2019 showed the percentage of businesses finding it difficult to access finance was around 30% and those that found it easy had dropped to 9%. There have been some changes in the industry to try to help the SME market.

A Sensis Business Index report released in February 2019 showed the percentage of businesses finding it difficult to access finance was around 30% and those that found it easy had dropped to 9%. There have been some changes in the industry to try to help the SME market.

The government has announced a $2bn securitisation fund to help make finance available to small business owners more affordable by lowering the wholesale cost of funds for alternative lenders.

“There are now so many lenders on the market; brokers are becoming more important as they help SME owners navigate the options” Tas Tzimos, Moula

With the mainstream banks pulling back, research shows that SMEs are turning more and more to those alternative lenders. Fintech SME lender Prospa commissioned a report to assess its impact on the small businesses it lends to.

It found that its lending had contributed $3.65bn to nominal Australian GDP and resulted in more than 52,000 annual full-time equivalent positions being maintained over the period 2013–18.

More than one in four businesses surveyed were unsure whether they would still exist without Prospa’s lending.

Matt Bauld, Prospa’s general manager of sales and business development, says there has been increasing red tape making it harder for small businesses to access finance from traditional lenders.

“Traditional loan applications can take weeks just for a response, and often require a family home as collateral,” he says.

“So many traditional products aren’t designed for small business owners, which can be frustrating for both brokers and their clients.”

But this is providing an opportunity for alternative small business lending. “Small businesses are looking for a lender who listens to what they need and delivers the right solution without the red tape,” Bauld says.

The opportunity extends to brokers, and Bauld says he has seen a shift in the broker mindset towards diversification.

“The good news takeaway from all this is that SME lending is back and looks like it is going to stay” Dean Koutsoumidis, Equity-One.

Brokers can help their small business customers navigate the confusing red tape and changing bank appetites to find the right lender for their needs.

“Brokers are more important than ever for promoting choice and competition in small business lending, and the future looks very bright for those that step up and embrace the opportunity,” Bauld says.

With research showing that the majority of small businesses would rather not use their property as security, brokers are well placed to guide their small business customers to options that allow them to avoid that.

Offering unsecured business loans is one of the big advantages of fintech lenders, says Moula head of sales Tas Tzimos.

Moula saw a 51% increase in loan approvals in September 2018 from June 2018, and Tzimos expects growth to continue as falling house prices have led some banks to refuse residential property as security for business loans and others have decreased their loan-to value ratios for business loans secured with residential property.

“Fortunately, fintech lenders have been filling the gap in the market to meet the finance needs of SMEs,” he says.

“However, as there are now so many lenders on the market, brokers are becoming more important as they help SME owners navigate the options and find the right one for them.”

While traditional bank loans may be taking up to two months to process, fintechs are able to provide a faster and more streamlined service.

Moula’s applications can be completed in 10 minutes and a decision can usually be made within 24 hours, meaning brokers can provide an “outstanding service”, Tzimos says.

Moula has invested in brokers, and in 2016 the compound growth rates of its partner channel hit 100% per annum for the first time.

“As Moula’s SME borrowers work to escape the restrictions of mainstream fi nance, Moula believes that the broker channel will gain even further signifi cance,” Tzimos says.

Small businesses are commonly labelled as the backbone or the engine room of the Australian economy.

But we can become numb to phrases like this and end up listening to them with a degree of cynicism, says Equity-One MD Dean Koutsoumidis.

He says these businesses are not just the engine room; they are most of the moving componentry of the economic vehicle.

“Whether it is a mum-and-dad fish and chip shop in Albury or a plumber in Collingwood, or even a multigenerational family-owned business boasting dozens of employees, the fact is that money is the lifeblood of these businesses, and without continuity of cash, things go pear-shaped – fast,” Koutsoumidis says.

As we have seen, however, that continuity of cash has been harder to come by. Things are also harder for SMEs because of the way banking has changed.

Koutsoumidis says that in the past the business owner could discuss their issues with a branch manager who knew the business and the finances.

These business owners are now dealing with algorithms, automated systems and heavy criteria instead of humans. SME lenders – even fintechs – are filling that gap to provide a personal experience.

Equity-One also tries to bring that human element to working with the broker channel by engaging with brokers and talking through scenarios.

“The good-news takeaway from all this is that SME lending is back, and looks like it is going to stay,” Koutsoumidis says.

A new addition to the commercial lending scene is Pepper Money, which expanded into the space as traditional lenders pulled back.

“In recent years we have seen exciting growth in lenders in the SME space; customers now have more access to capital than ever before to help them grow and thrive,” says head of commercial Malcolm Withers.

“[There is] a significant opportunity for a broker to evolve and develop their business to be more than just a mortgage broker” Malcolm Withers, Pepper Money

“But whilst we see growth in new lenders delivering solutions, we are also seeing traditional bank lenders become more restrictive in their approach to credit and slower in handling applications due to the recent regulatory reviews.”

Withers often considers the question, “When did commercial lending become so complex?” This was front of mind as Pepper developed its new offering.

The lender aims to be flexible and nimble and provide simple policies.

In the first five days of launching its commercial arm, Pepper had brokers respond with more than 1,000 accreditations completed.

It has been driving awareness of its new products and policies through email campaigns and webinars.

Having also launched its commercial broker portal, it will be encouraging brokers to take part in a series of commercial broker forums.

Withers says brokers can service their customers who are struggling due to “the growing gap between what a customer wants and what banks are able to provide”.

On one hand, the SME customer wants a dedicated business banker who understands their business. On the other, the banks are grappling with how to deliver this in a rapidly growing SME market.

“This presents a significant opportunity for a broker to evolve and develop their business to be more than just a mortgage broker for their self-employed clients,” Withers says.

Original written by Rebecca Pike, Mortgage Professional Australia, 27 May 2019.