Commercial’s Big Break

- Original article by Australian Broker

- 5 August 2019

From non-residential property to asset and construction finance, by some estimates untapped commercial lending opportunities are currently worth $85bn. But when it comes to finding solutions for clients, Australian Broker finds that there is more to the sector than meets the eye

As with other areas of the lending environment, recent months have seen a contraction in the availability of commercial credit. Yet demand for commercial lending solutions remains strong – so strong in fact that, according to La Trobe Financial, unmet lending needs could be worth as much as $85bn.

As has happened elsewhere, a contraction in mainstream banking has heightened demand for the non-banks to meet the credit shortfall, which sounds simple enough. However, Steve Lawrence, vice president and head of major clients at La Trobe Financial, says the current situation has actually brought about a steady rise in market complexity.

“Whilst the financial landscape is as challenging and complex as it has ever been, we have always held the opinion that where there is complexity, there is opportunity. We believe that, with strong conviction, right now it is a golden opportunity for brokers to increase commercial market share and grow their businesses,” Lawrence says.

Observing several growth areas in the market at this time, Lawrence says there are hundreds of opportunities for brokers to unlock for their clients.

The first growth area is self-managed super funds, where smaller SMEs place their owner-occupied commercial properties in their SMSFs for investment and tax purposes.

Secondly, Lawrence says vacancy rates in the office market – which currently stand at a 10-year low – confirm there are four hotspots across the country at this time, each at different points in their own respective property cycles. These are Sydney and Melbourne, which are currently both strong, and Perth and Brisbane, which are both showing strong gains and future potential.

“Whilst the financial landscape is as challenging and as complex as it has ever been, we have always held the opinion that where there is complexity, there is opportunity” Steve Lawrence, vice president and head of major clients, La Trobe Financial

Thirdly, the property development sector is seeing a shift too, with demand for rental premises driving growth in commercial construction.

“The finance market has become highly complex for consumers who do not know who to turn to, and these unknowns and complexities are the fuel that drives finance broker growth,” says Lawrence.

“Today, consumers are experiencing a high level of uncertainty, low confidence and brand confusion in the finance world, therefore finance brokers are, and will continue to be, highly sought after.”

Adapting to change

Change has defined the finance industry over the last year, and Peter Vala, GM of partnerships and distribution at Thinktank Commercial Property Finance, says commercial lenders – as well as brokers – must pivot in order adapt and capitalise.

“As with residential finance, commercial lending has also felt the effects of change and in many instances has become more difficult to obtain, and mostly from traditional sources,” Vala says.

“This pace of change is seemingly continuing to accelerate, whether in relation to lender policy, loan products, compliance or regulatory intervention, as well as new entrants, including fintechs and neo-banks. But with great change also comes great opportunity.”

Among these areas of opportunity, Vala identifies a number of target areas that brokers should consider.

For example, using lenders that are fully committed to brokers and with limited or no direct customer contact can serve to avoid the difficulties that can arise through channel conflict.

“Brokers have access to a greater depth and breadth of lending choices than their client will ever have, particularly if that client is time-poor like so many people are these days. This great advantage is primarily what raises the broker proposition – to provide informed choice and real alternatives not previously considered or easily accessed by a client on their own,” he says.

Additionally, Vala recommends that brokers carefully assess the criteria a borrower must meet under each lender’s policy. This goes all the way from providing traditional full financial statements and tax returns, through to staggered alternative income verification options.

Thinktank’s alternative income verification solutions work on the client’s declared income, supported by either an accountant’s letter, recent BAS statements or bank statements. This documentation can be used to support a commercial or residential property loan, and post-settlement borrowers have the option to convert to a lower-rate full-doc loan, once their financial statements are updated and serviceability confirmed, for a minimal administration fee.

“The subtle and stark differences in assessment criteria and supporting documentation for credit assessment are increasingly apparent amongst lenders” Peter Vala, GM partnerships and distribution, Thinktank

“The subtle and stark differences in assessment criteria and supporting documentation for credit assessment are increasingly apparent amongst lenders. For example, how would your self-employed or SME-owning borrower secure residential finance if their current financial statements and tax returns are not up to date, especially if the most recent year’s trading and profitability performance has changed, possibly improved?

“Some mainstream lenders have actually pulled out of this space, while others, mostly non-banks, continue to support it strongly,” he says.

In the midst of the political and regulatory challenges that have contributed to the current environment, non-banks are the fastest-growing and “most innovative” funding providers, says Vala. “Change in and of itself serves to drive innovation to create and find solutions to meet ever-changing customer needs.

“Brokers happen to be the constant in delivering a critical service in the midst of a market that now offers a broader range of products and services than ever before. Non-banks are proving to be the fastest-growing and most innovative and, being so closely aligned to the broking channel, it will be the brokers and their clients who embrace this trend who will benefit the most.”

Flexible alternatives

Equity-One has seen first-hand the fallout from recent changes in bank policy, noting an increase in enquiries from commercial borrowers who were, until recently, ‘bankable’.

As MD Dean Koutsoumidis notes, these prospective borrowers have transacted on good assets and previously enjoyed good relationships with their banks, but all of a sudden they have found themselves in need of an alternative. “We continue to hear from brokers about a client that has provided everything required by the bank and for some inexplicable reason the bank doesn’t want to transact,” he says.

However, the search for an alternative can only be fruitful if a true alternative exists in the marketplace.

“We encourage brokers to engage with us, to work through their clients’ needs so we have a clear understanding of what the required outcome is. Equity-One prides itself on bringing the human element to working with brokers and their clients, rather than the algorithms, automated systems and red tape,” Koutsoumidis says.

Walking the walk, Equity-One recently addressed the need for true alternatives by offering borrowers the opportunity to repay their fixed term loan early without any fees or costs, giving the borrower the flexibility to return to their bank should the opportunity – and associated change in their circumstances – arise.

“We continue to hear from brokers about a client that has provided everything required by the bank and for some inexplicable reason the bank doesn’t want to transact” Dean Koutsoumidis, managing director, Equity-One.

Under new lending criteria, there are many reasons why a borrower could be rejected by their bank, and the time it takes to get a decision on a bank loan application, along with the lack of human contact during the customer experience, are just two of the additional reasons Koutsoumidis believes commercial borrowers are choosing not to deal with mainstream banks.

“Without sounding like a broken record, we continue to see commercial borrowers looking for alternative commercial lending solutions to ensure their business doesn’t get bogged down in red tape and can continue to grow and flourish,” he says.

“Every client is unique, and what may be a perfect fit for one client won’t be for another, so a broker’s knowledge of products is imperative, and knowing what their client’s short- and long-term goals are will go a long way to having a client for life.”

Taking commercial online

The internet provides solutions to many needs, and commercial lending is just one. As this trend has converged with the fallout from the royal commission, awareness of online commercial lending solutions has grown significantly over the last year.

Research conducted by alternative SME lender OnDeck found that 42% of those who had previously had an application rejected by a bank had looked online for a new solution. Further, 22% of SME owners said they would consider an online lender in future, and, with 50% of businesses turning to a broker to help source the funds they require, knowledge of alternative commercial lenders is crucial.

“As awareness grows with regard to the benefits that alternative financiers can offer compared to traditional lenders, and more SME customers look for optionality beyond banks, lenders like ourselves are become increasingly mainstream,” says Cameron Poolman, CEO of OnDeck Australia.

“This growth is a win-win for brokers and their clients. It’s not just about brokers broadening their revenue streams, though of course that is a key benefit. Ultimately, this is about brokers being able to better service SME clients, both in terms of providing more timely access to capital and also offering choice and flexibility where they don’t want to be encumbered with security on their personal or business assets.”

Leading by example when it comes to serving SME borrowers, last year OnDeck launched a dedicated equipment finance loan when it discovered that many of its loans were being used to cover the cost of equipment.

With heightened activity has come a new focus on regulation of the online sector, and last year OnDeck was also one of seven signatories of the Lending Code of Practice. The guidelines were designed to bring greater transparency to the SME finance sector and were backed by small business ombudsman Kate Carnell. As part of the work, OnDeck brought its SMARTBox™ loan comparison tool to the Australian market.

“We have seen a shift towards greater transparency over the last 12 months,” Poolman says.

“Transparency, as offered by the AustraliaCode and SMARTBox™, is fundamental to our industry’s development and, most importantly, to supporting the success of Australia’s small business economy.”

Looking ahead, Poolman believes these factors will continue to drive growth in online SME lending, along with other developments. For example, the instant asset write-off, which increased from $20,000 at the beginning of 2019 to $30,000 at present, has spurred SMEs to invest in new assets and equipment, supporting uptake of OnDeck’s new equipment finance loan.

There are other factors at play, too. As new challenges emerge in the operating environment, many SME owners are recognising that the time taken to organise mainstream funding can come at a cost to their business.

“As technology advances and Australian SMEs are increasingly competing in a global marketplace, this time-saving can give a small business a valuable competitive advantage,” Poolman says.

“Ultimately, this is about brokers being able to better service SME clients, both in terms of providing more timely access to capital and also offering choice” Cameron Poolman, CEO, OnDeck Australia

The bottom line

It’s unlikely the mainstream banks will continue to allow the non-banks to encroach on their market share, but stranger things have happened.

As the market waits for their return, non-bank lenders will continue to put their money where their mouth is, focusing on high-quality customer interactions and support of third party distribution.

“There’s no doubt the coming years will continue to bring change,” says Koutsoumidis.

“It seems unlikely that any sector or subsector within financial services will remain untouched by the royal commission, but our approach and principals around lending do not change to market conditions. We will always seek quality transactions in both bull and bear markets.”

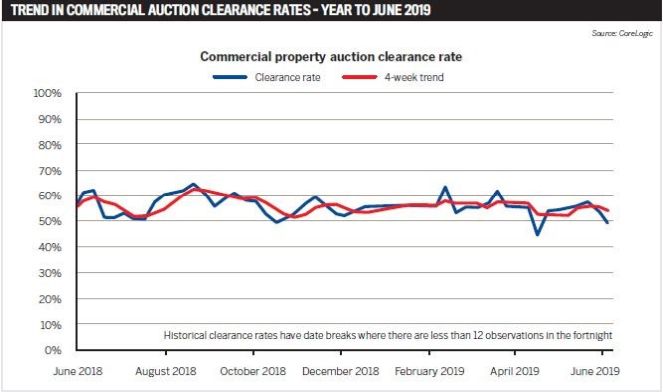

Credit conditions in the commercial sector are having an impact on commercial property sales and auctions, as well as the wider business environment and, ultimately, the economy. But if brokers play their cards right, they could still come out on top.

“In the wake of the major banks’ credit tightening measures and product simplification strategies, finance brokers have a golden opportunity to increase market share,” Lawrence says.