Expanding Choices For Borrowers

- ORIGINAL ARTICLE BY MORTGAGE PROFESSIONAL AUSTRALIA

- 27 February 2020

MPA sits down with Equity-One managing director Dean Koutsoumidis to hear the story behind the group, the changes and challenges it has faced, and how it continues to evolve.

MPA: What were you doing before you set up Equity-One?

Dean Koutsoumidis: A long, long time ago – in 1989 – the world of financial services appealed to me. Fresh out of high school, I completed a Diploma of Financial Planning via Deakin University as I had ambitions to be a financial planner. Then I started as a paraplanner at Hillross, a subsidiary of AMP. When the early ’90s came along, we were in the midst of a pretty tough recession. Financial planning was not front of mind for people. I did, however, come across this strange world of finance broking.

I figured that selling loans (certainly in the early ’90s) resonated with people more than funds management. So I applied for a finance broker’s licence (which interestingly was through the same government department that licensed car salesmen and pawnbrokers – but enough about that). Needless to say, a career in selling mortgages ensued, particularly as in 1990 having someone visit your home to talk about a loan was unheard of. It was almost as exciting as having a pizza delivered for the first time, which was also a ’90s wave of change.

As the ’90s rolled on, I found my niche in procuring commercial loans for customers who were not quite accommodated by the major banks. Bear in mind that there was no such thing as securitisation, white labelling, aggregator panels, trail commissions, clawbacks, etc. I focused on the world of non-bank lending, which back then was commonly referred to as ‘private lending’. This was predominantly the domain of law firms that ran contributory mortgage practices. Over time, with the introduction of new legislation around AFSLs and management investment schemes, the private lending landscape changed and contributory legal practices sold their books, morphed into managed funds, or simply shut up shop.

MPA: What is the story behind Equity-One and how has it developed?

DK: Despite the constant changes, it was clear to me that the world of non-bank lending was here to stay, for a while at least, and I established Equity-One, which effectively emulated the contributory-style legal practice of days of old.

This appealed to retail investors, particularly those who enjoyed dealing with their respective legal practices when investing their money. Equally, the borrowers who were good candidates for these loans enjoyed the simplicity of the interest-only commercial loans, and it certainly was in demand. Nothing much has changed in that regard.

MPA: What challenges have you faced and how did you overcome them?

DK: Starting a new fund wasn’t without its challenges. We often talk about ‘start-ups’ nowadays, and it seems to roll off the tongue with ease, as if to ‘start up’ is a light, effortless event. It is not.

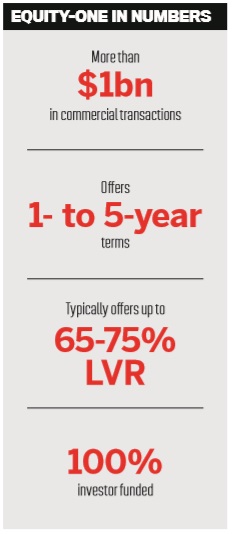

Starting a new fund was a challenge. There were significant hurdles to overcome, such as the regulatory requirements, legal costs, systems implementation, and the usual run-of-the-mill aspects of any business that is starting up. Equity-One, however, was very soon in demand, from both borrowers and investors. Our growth has been organic and built on our core values, which have not changed since inception; that is, being relevant to both investors and borrowers and achieving great outcomes for our clients.

Challenges in our business can present themselves in various ways. There are the old pillar risks, such as property market risk and borrower default risk; however, as the lending landscape evolves, so too do the risks.

Whilst these traditional risks remain, newer (and equally lethal) risks have emerged, which include compliance obligations and the challenge of new, nimble participants.

These risks are somewhat more elusive and seem to be constantly changing. This is the way it is for all participants, though. And if you are planning on being here to stay, then you need to be adequately prepared to take on and manage these risks. That’s the price of being in business today.

MPA: How have things changed in the market since Equity-One’s inception?

DK: As the ’90s came and went, we entered a new era in which we saw the emergence of large players in the non-conforming lending space. Many of these lenders are still with us and have become some of the trusted brands in the lending landscape. Others, however, have not. We have seen the landscape change in many ways, such as how brokers are remunerated, new ‘efficiencies’ such as aggregation panels, and let us not forget the ever-growing world of compliance obligations.

All of this, I believe, has been for the better, with choices for borrowers continually expanding. This is a good thing, too.

Whilst I was the MD of Equity-One and focused on its growth, I spent some time doing business in New York. Doing business in America was certainly an education. One of the things that stood out for me, right from the outset, was how fast New Yorkers wanted to communicate. To clarify, not in terms of the speed of their communication per se, but in the speed of the replies they expected. Conversations, as I saw it, were of a higher ‘tempo’. Decisions needed to be made faster. Expectations for decisions were naturally set to a higher bar than I was used to in Australia. I realised that we would soon follow this style of doing business; that is, people want to hear from you, and they want to hear from you fast. This is now not a global phenomenon but rather a global norm. Business, in the finance world, is done fast. And we now have all the digital tools to do just that. Impressive, huh? But despite the rapidly changing environment, our core values still hold true. We are very proud of the old-school nature of how we serve our clients. Whilst implementing nifty digitisation, which has quickly become the norm in business today, we nevertheless do not forget that simple, straight conversations with people are key to good business, and good outcomes. We do, after all, deal with humans.

MPA: What do you expect to see in the year ahead?

DK: I believe the competition will increase. Non-bank lending is a large market in Australia, and despite the majors’ efforts to accommodate the demand, many borrowers are still left unserviced. This presents opportunities for new players to find their place in the food chain without necessarily worrying about scale. So we will continue to see the market mature. Once we reach that point, I suspect we will see a consolidation. This may not play out in 2020 but is inevitable in the medium term. Compliance obligations will also be a major focus for organisations. We may see new obligations around capital adequacy and perhaps a fresh look at the definitions of ‘wholesale/ sophisticated’ investors. One thing is certain, and that is change.

The challenge for commercial lenders is to continue being relevant to their customers, and, quite simply, offer products that enable good outcomes. Isn’t it nice that a little bit of the ’90s is still with us?

Original article released by Mortgage Professional Australia, 27 February 2020.